11 Best WooCommerce Payment Gateways Compared [2022]

by

7-layers of Security for Your WordPress Site

Your website needs the most comprehensive security to protect it from the constant attacks it faces everyday.

Some of the things to consider when picking the right WooCommerce payment gateway are whether it’s easy to integrate, is the plugin free, and are the settlements quick and easy.

You may have other questions as well. Should you pick a payment gateway for WooCommerce that:

- Redirects customers offsite or not?

- Has a low per-transaction fee but a subscription fee?

- Accepts more currencies or has more payment options for customers?

In this article, we’ve done the digging and checked the nuances of the best WooCommerce payment gateways available. We also elaborate on the factors you should consider when picking the best payment gateway for WooCommerce, armoring you with enough knowledge to make an informed decision. Keep reading to see which one best suits your needs, and get your ecommerce business going.

TL;DR Our recommendation is WooCommerce Payments, especially for a small site that is just starting out. It doesn’t have the most number of supported payment types or currencies, but it treads the middle road effectively. PayPal Zettle is an integrated offline and online system, but experiences failures too often for comfort. Authorize.net has the best options, but is prohibitively expensive for a fledgling or small store.

11 Best WooCommerce payment gateways compared

WooCommerce makes it very easy to integrate a payment gateway into your site. Several major payment gateways for WooCommerce have existing integrations in the form of plugins.

Best WooCommerce payment gateways in this list power thousands of businesses in the world, especially in the US and Europe. We’ve put each of them through their paces, so you can zero in on the best one for your site. We’ve also included a comprehensive list of the criteria that you should use when making a decision.

Best WooCommerce payment gateways:

- WooCommerce Payments

- PayPal Zettle

- Amazon Pay

- Square

- PayFast

- Authorize.net

- Braintree

- Alipay

- Opayo

- Skrill

- Verifone

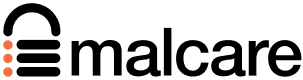

1. WooCommerce Payments

Best for: Merchants based out of the US and EU, as WooCommerce Payments is the only payment gateway on this list that is actively expanding their range of operations.

The first payment gateway on our list is WooCommerce Payments, because it is the natural choice to opt for something within the WooCommerce ecosystem. We wanted to see how it works, especially since all the other payment gateway integration plugins made by WooCommerce proved to be unreliable and unusable in a lot of cases.

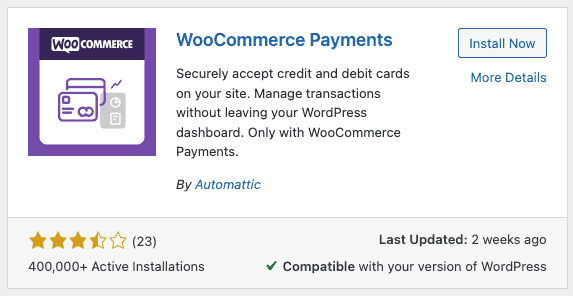

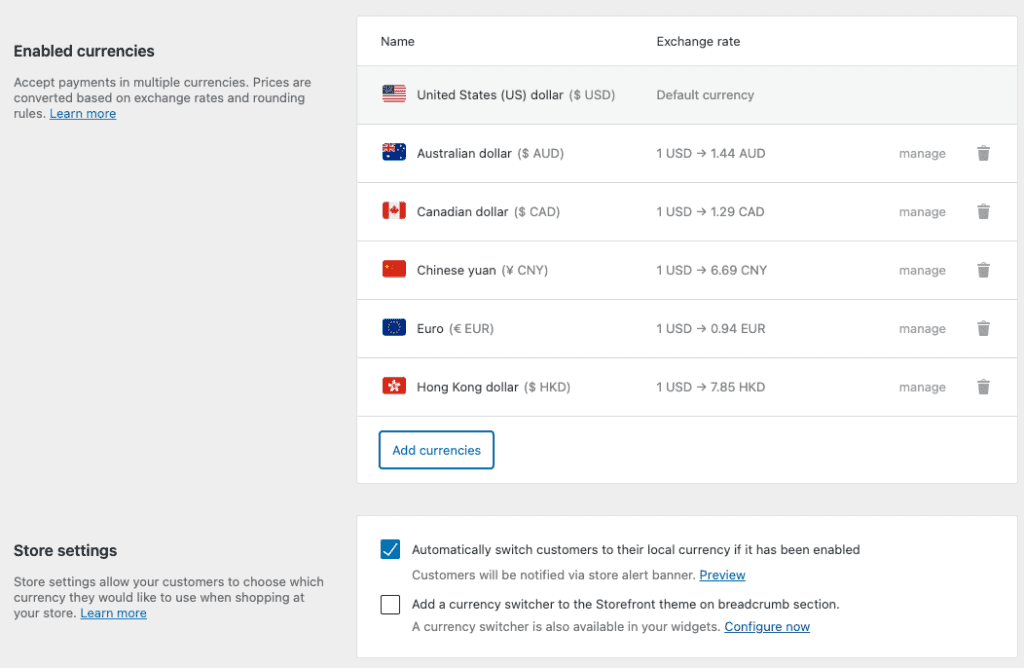

Interestingly, WooCommerce is powered by Stripe, which is a leading provider of payment solutions. It supports all major types of payment methods, which of course carries on to WooCommerce Payments as well. A lot of Stripe’s great features are built into WooCommerce Payments: it supports over 135 currencies and fraud prevention is included with all the plans. Plus, the plugin has Stripe’s great interface.

At present, there are a limited number of supported regions, however WooCommerce Payments actively adds new countries all the time. If your country is not supported right now, you can request it be added on their website.

Features

- Integrated WooCommerce payment gateway

- Supports direct payments and subscriptions out of the box

- Powered by Stripe

- Supports over 135 currencies

Pros

- Integrated fully with the wp-admin dashboard. No need to log into an additional dashboard to manage payments

- Flexible settlement options. Regular payout every business day, with the option of instant payouts if required

- Payouts to debit cards also available

Cons

- Unintuitive account link. If you want to change the Stripe account on your merchant site, you need to reach out to customer support

- In the case of refunds, the transaction fee charged by WooCommerce Payments is not refunded

Pricing + fees

- No setup costs or monthly fees

- Per transaction fee that is dependent on the location and the method of payment used. For example, credit card transactions in the US are charged 2.9% + $0.30 per transaction for a US-issued credit card. Additional charges are applied for other currencies and credit cards issued outside the US

- $15 per dispute, which is refunded in case you win the dispute

Available regions

Australia, Austria, Belgium, Canada, France, Germany, Hong Kong, Ireland, Italy, Netherlands, New Zealand, Poland, Portugal, Singapore, Spain, Switzerland, United Kingdom, United States

Payment methods

Credit cards, debit cards, bank transfers, Google Pay, and Apple Pay. Cash on delivery and in-person payment options available for US and Canada.

2. PayPal Zettle

Best for: An integrated payments solution for online and offline payments, which require a robust POS system.

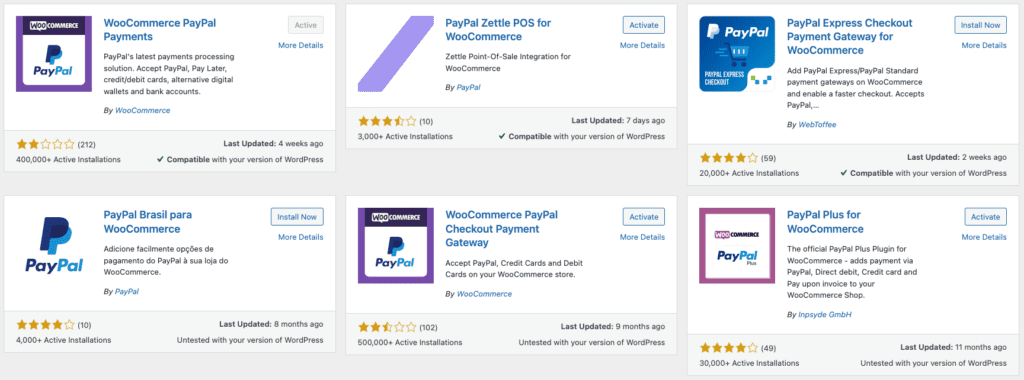

There are a few ways to integrate PayPal with WooCommerce, depending on who has built the integration plugin. There are the main plugins: the WooCommerce one made by Automattic and Zettle by PayPal. And some third party ones: PayPal Express Checkout, PayPal Plus for WooCommerce, and even another flavour of checkout called Braintree by PayPal. As you can see, there are a bewildering number of options available.

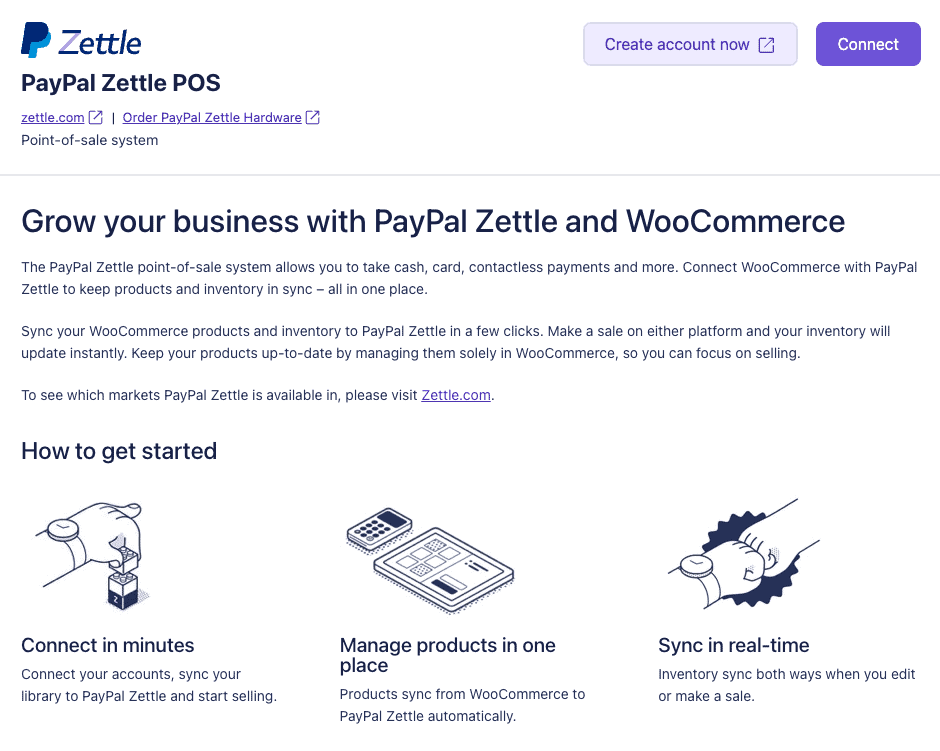

We tested out Zettle, which is a PayPal product that spans online and offline payments in one solution. You can have POS systems and credit card readers if you have a brick and mortar store, and use the same system to manage online transactions as well.

As it is PayPal, one of the most popular payment solutions worldwide, Zettle accepts all major credit and debit cards, and is therefore PCI compliant. We give you a better understanding of what it means to be PCI compliant later on in this article.

Features

- Online and offline payment solution with POS system

- Manage your payments with an app

- Integrates with your inventory

- Settlement time is typically 1 business day

- Custom build your checkout experience

- 100+ currencies accepted

Pros

- Pay later option, with an instalment solution powered by PayPal Credit

- Supports subscriptions and recurring payments out of the box

- Support for QR codes and all means of online and offline payments

- No merchant account required, and works for any size of business or individual

Cons

- External dashboard for managing account, unless you opt for the WooCommerce integration plugin

- Not as reliable as other WooCommerce payment gateways. At least 10% transactions fail on an average

- Increases in costs are frequent

- Initial setup can be tricky

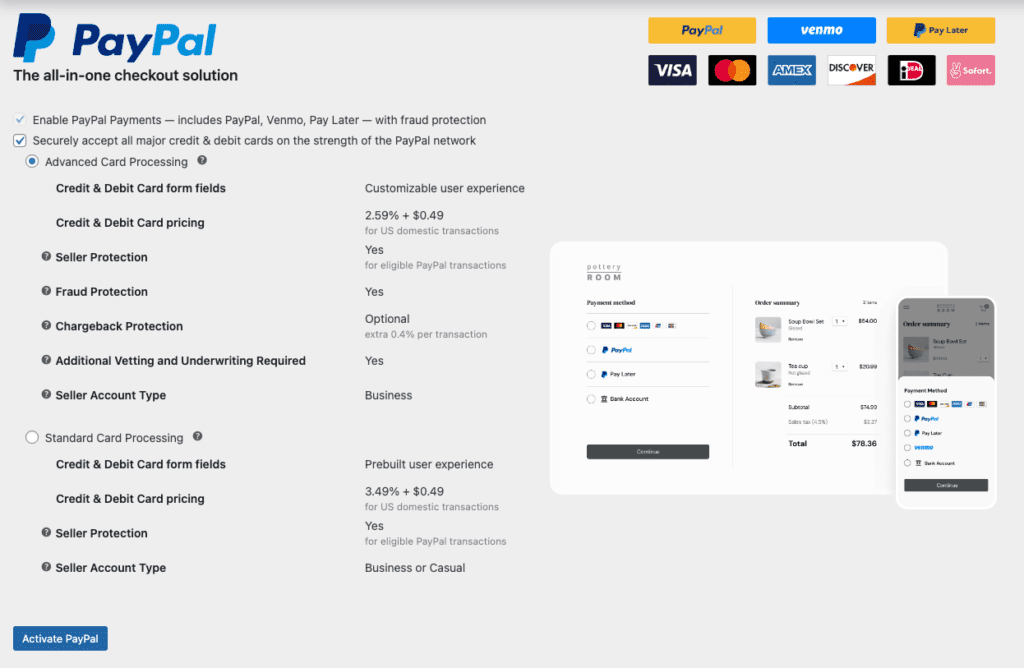

Pricing + fees

- 2.59% + $0.49 for US domestic transactions

- $29 for the first card reader, and $79 for every additional device

Available regions

United States, Sweden, Great Britain, France, Germany, The Netherlands, Norway, Denmark, Finland, Mexico, Brazil, Spain, Italy

Payment methods

Credit and debit cards, Venmo and other digital wallets.

3. Amazon Pay

Best for: Merchants situated in the Middle East

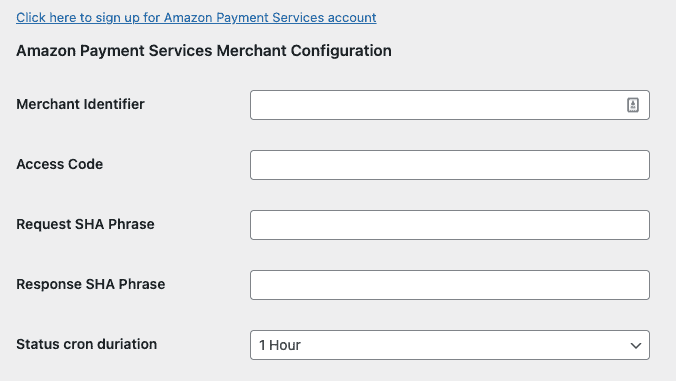

There are two options to integrate Amazon Pay into your WooCommerce store. One is the WooCommerce plugin, and the other is the Amazon Pay Services one. Amazon Pay Services is exclusively for businesses in the Middle East region.

By itself, Amazon Pay is a seamless payment experience. However the integration plugin by WooCommerce is unreliable, so it becomes problematic to use effectively. As of now, there are few other alternatives to using the plugin.

The advantage of using Amazon Pay is that it is a well-recognised brand, so it confers a certain degree of trust. Plus, the customer will have an account with Amazon. However, the flip side to using Amazon Pay is that the customer needs to have an account with Amazon.

Features

- Subscription and recurring payment support

- Pre-orders are supported

- Settlement in 1 business day, although in some cases there is a 14-day hold

Pros

- Very easy to integrate

- Hosted payment gateway, so Amazon Pay works by showing a secure popup on your site

- Built-in fraud protection services for merchants

Cons

- Only for accepting payments via Amazon Pay. If you want to offer more payment options, you will need to enable them separately.

- Integration plugin is buggy and prone to failures. It also crashes the site

- Lots of reported payment failures

- Your site needs to be PCI compliant to use Amazon Pay

- Amazon is trigger-happy and can terminate a merchant’s account without any warning

Pricing + fees

- 2.9% + $0.30 per transaction fee for US domestic online transactions

- Non-refundable chargeback fee of $20 plus tax

Available regions

- Amazon Pay Services: Saudi Arabia, United Arab Emirates, Egypt, Jordan, Lebanon, Qatar, Kuwait, Oman

- Amazon Pay: United States, United Kingdom, Austria, Belgium, Cyprus, Denmark, France, Germany, Hungary, Ireland, Italy, Japan, Luxembourg, the Netherlands, Portugal, Spain, Sweden and Switzerland

Payment methods

Credit and debit cards

4. Square

Best for: A decent alternative to PayPal Zettle, and good for smaller stores.

Like most of the other major payment gateways, WooCommerce has an integration plugin for Square. And much like the other integration plugins, this one too suffers from the same reliability issues. The official Square integration though is available as an extension from the WooCommerce dropdown menu on the admin dashboard. We opted to use the extension instead of the plugin, and the experience was markedly better.

You will have to have an SSL certificate installed on your site for Square to work. However, this is an important security measure, so we recommend doing so anyway.

Overall, Square is a great WooCommerce payment solution that sets up quickly and works out of the box.

Features

- Integrates offline and online payments in one system, and includes a POS

- Supports subscription, recurring payments, pre-orders seamlessly

- Two dashboards – Square and Woocommerce. Both dashboards sync automatically

Pros

- Square takes on the burden of PCI compliance

- Bundled solution for taking payments anywhere—offline, online, mobile payments—in the form that is comfortable for customers

- Wide range of accepted payment options

Cons

- Product sync is messy for nested categories and tends to get messed up on the Square dashboard which doesn’t support nested categories

- Most insights and admin will need to be done through the Square dashboard

Pricing + fees

- 2.9% + $0.30 per transaction fee for US domestic online transactions

Available regions

U.S., Canada, Australia, Japan, Ireland, France, Spain and the UK

Payment methods

Credit and debit cards, payment wallets, Apple Pay and Google Pay

5. PayFast

Best for: Merchants based out of Africa.

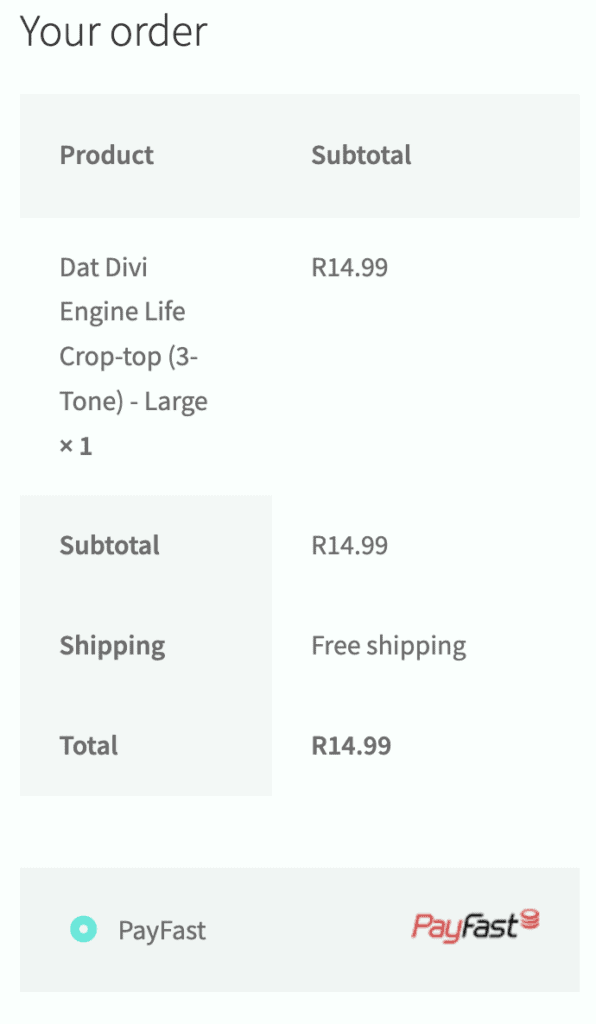

PayFast is a South African payment gateway, which is available in a few neighbouring countries as well. As with the other entries on this list, there is a WooCommerce-built integration that is supported by WooCommerce. PayFast support is only available locally.

To set up the plugin, you will need to change the currency to South African rands in the settings. It is by far the easiest setup process we have come across. There is no lengthy signup and verification process that you see with US-based gateways.

Features

- Subscriptions and recurring payments supported. However these payments cannot be managed by PayFast. They are managed by WooCommerce, which then generates a payment request using PayFast. In their documentation, they call this tokenized billing.

- Integrated payment gateway, so burden of PCI compliance lies with them

Pros

- Very easy setup process

- Wide range of payment methods accepted, especially those used in the target regions

Cons

- Support for the integration plugin is managed by WooCommerce not PayFast

- Only local support available

Pricing + fees

- 3.2% + R 2.00 per credit card transaction

- Flat fee of R8.70 per settlement

- R2.00 per refund

Available regions

South Africa, Lesotho, Botswana, Swaziland, Namibia, Mozambique, Zambia, Zimbabwe

Payment methods

Credit and debit cards, EFT support, digital wallets, contactless payments, and payment apps

6. Authorize.net

Best for: An all-in-one WooCommerce payment gateway, if budget is not a consideration.

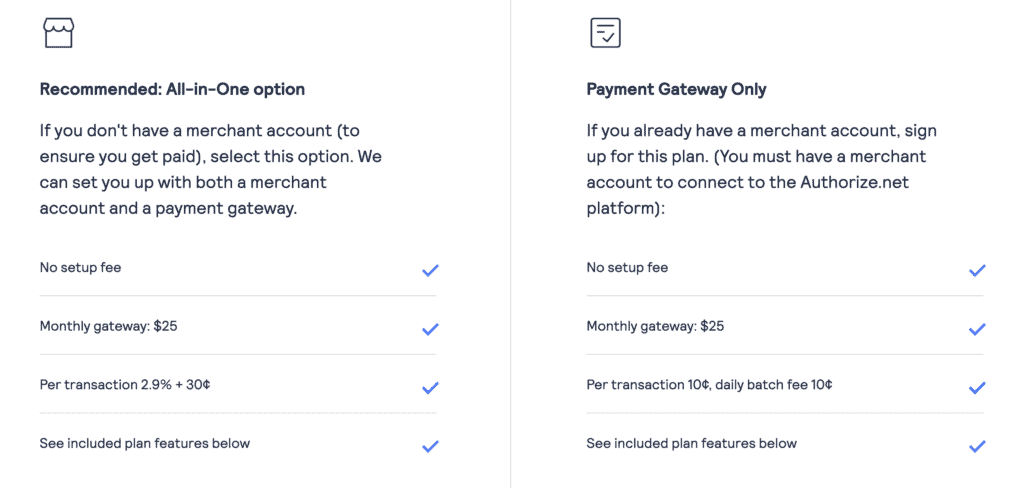

Authorize.net is one of the only payment gateways for WooCommerce that we have seen that gives you the option of signing up with them just as a payment processor, or a bundled payment gateway and processor. If you have a merchant account, or are planning to get one, this will mean a substantial reduction in transaction fees.

Authorize.net also accepts a wide range of currencies and payment types, which successfully makes payments seamless for customers. Additionally, because of the supported payment types, you can skip installing more than one payment gateway to cater to different payment options.

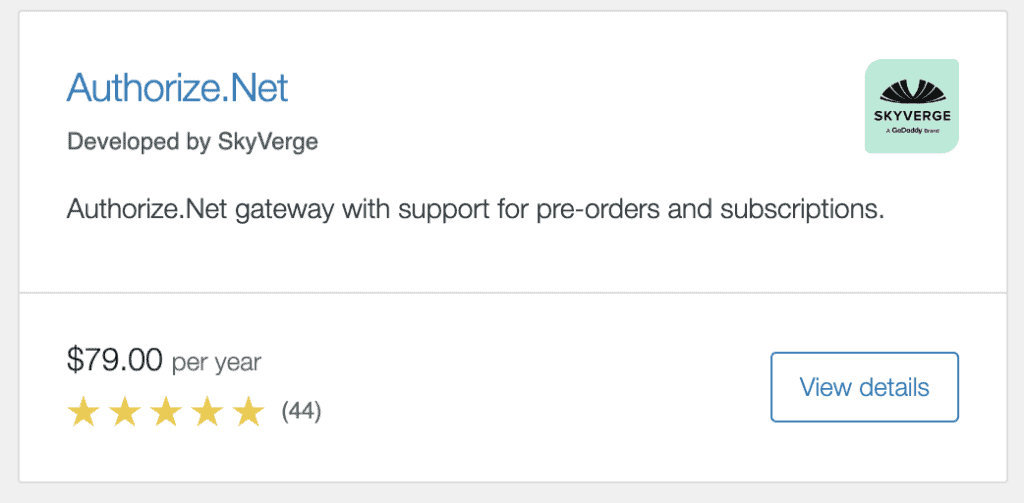

However, it is also the most expensive payment gateways on the list. Apart from the monthly subscription fee, there is also an annual fee for the integration plugin.

Features

- Integrates offline and online payments with a POS system

- Option of just the payment processor, or the bundled payment gateway and processor

- Supports subscriptions, recurring payments, pre-orders, and anything else that WooCommerce does

- Supports saved customer details

Pros

- Accepts the widest range of payment options

- Separates out gateway and processor for a really customised integration

- There are several integration plugin options available, apart from the stock WooCommerce one

- Has the option of being a hosted or integrated gateway

- Complete management from the WooCommerce wp-admin dashboard itself

Cons

- The monthly subscription free is steep, compared to other WooCommerce payment gateways

- The integration plugin is chargeable at $79 a year

Pricing + fees

- Monthly subscription fee of $25

- Plugin subscription of $79

- Per transaction fee of 2.9% + $0.30 (for the gateway + processor) or $0.10 + daily fee of $0.10 (for just the processor)

Available regions

United States, Canada, United Kingdom, Europe, Australia

Payment methods

Credit and debit cards, contactless payments, in-person payments, PayPal, Apple Pay, and eChecks

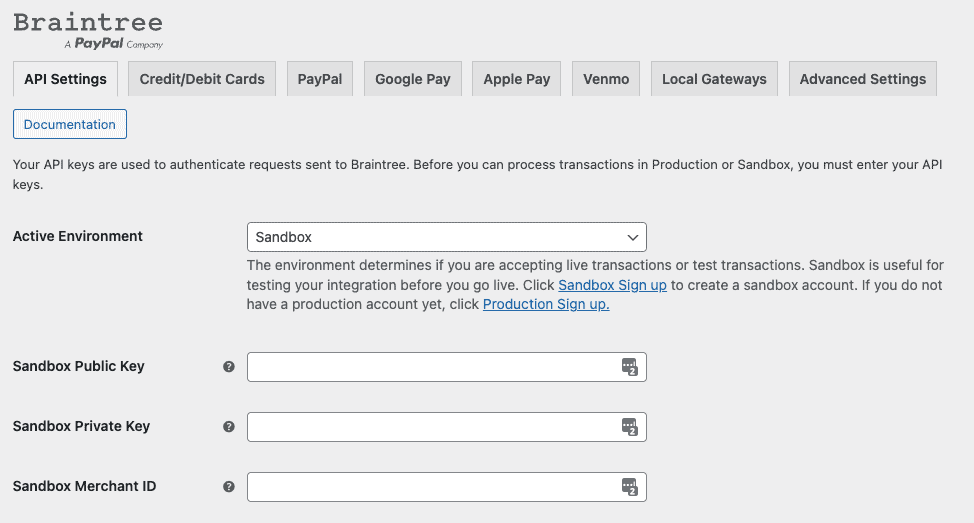

7. Braintree

Best for: WooCommerce site with a high volume of transactions.

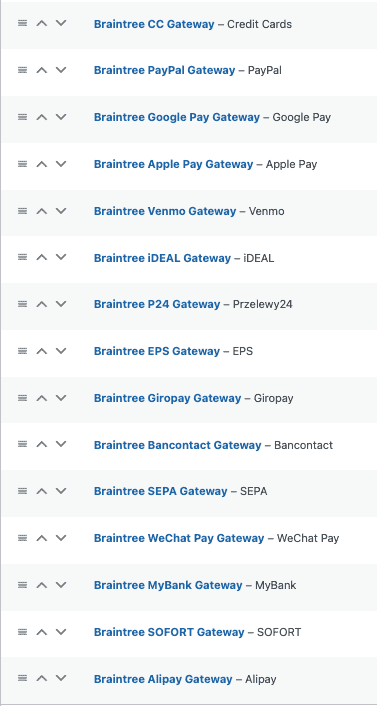

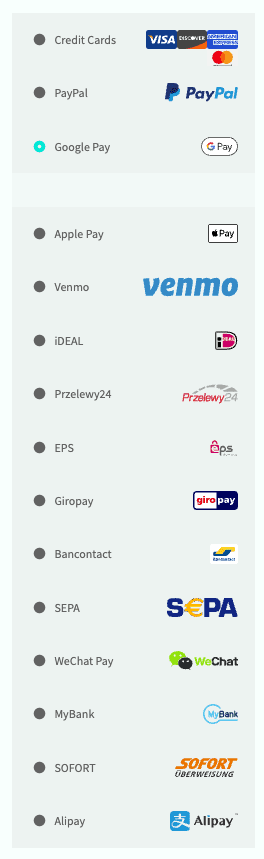

The most prominent thing that strikes you about Braintree is the staggering number of payment options it accepts. This is because Braintree, a PayPal company, is intended to be a global payments gateway. Its target audience are enterprise customers, who are likely to have customers across the world.

Braintree has a fantastic lineup of features, but it is definitely too much for a small business at first. For instance, you can only sign up for an account by contacting the Sales team. Next, reporting is only really useful for thousands of transactions, with features such as decline analysis, expiring cards, and so on. For an early stage business or a small store, this is daunting and not particularly useful information. Finally, all the payment options, while great, will rack up a sizable amount of fees. Everything beyond card and PayPal payments has additional fees, like surcharges for using other digital wallets and using currencies other than US dollars (apart from a currency conversion fee) for example. While you can deactivate those options, it does make using Braintree somewhat pointless.

Braintree is also designed to be a payment toolkit with which developers can build their own custom payment experience. Most smaller sites want an easy integration that works out of the box. There is an integration plugin for Braintree, but it barely scratches the surface of what the payment gateway can actually do.

Features

- Top level PCI compliance

- Built-in fraud management

- Recurring payments support

- Reporting integrations available as required

- 130 currencies accepted from 44 countries

Pros

- Accepts a wide range of payment options

- Widely available across the globe for merchants and their customers

- Offline and online solutions available

- Full-stack payment provider for payments over mobile apps and web

- Flexible payment solution

- Great support

Cons

- Steep chargeback fee per transaction

- Complex, sale-assisted setup only

- Cannot start accepting payments immediately

- Merchant account required

Pricing + fees

- Per transaction fee of 2.59% + $0.49 for US card or wallet transactions

- Chargeback fee of $15 per transaction

- Additional fees applicable for other currencies and payment methods

Available regions

United States, Canada, Australia, Europe, Singapore, Hong Kong SAR China, Malaysia, and New Zealand

Payment methods

Credit and debit cards, PayPal, Apple Pay, Google Pay, Alipay, WeChat, Venmo and other digital wallets, and other local gateways

8. Alipay

Best for: Merchants with customers in China.

Alipay is a digital wallet and payment gateway owned and operated by the e-commerce giant Alibaba. It is the most used payment gateway in China, therefore any ecommerce site targeting the Chinese market needs to have Alipay as a payment option.

There are a few integration plugins for WooCommerce, however most seem to be in Chinese and intended for Chinese merchants. There is also a WooCommerce approved extension, however it is chargeable at $79 annually, plus it requires an Alipay account to operate. Although it is not impossible for a merchant located outside China to have an Alipay account, there are a number of additional hoops to jump through to get one.

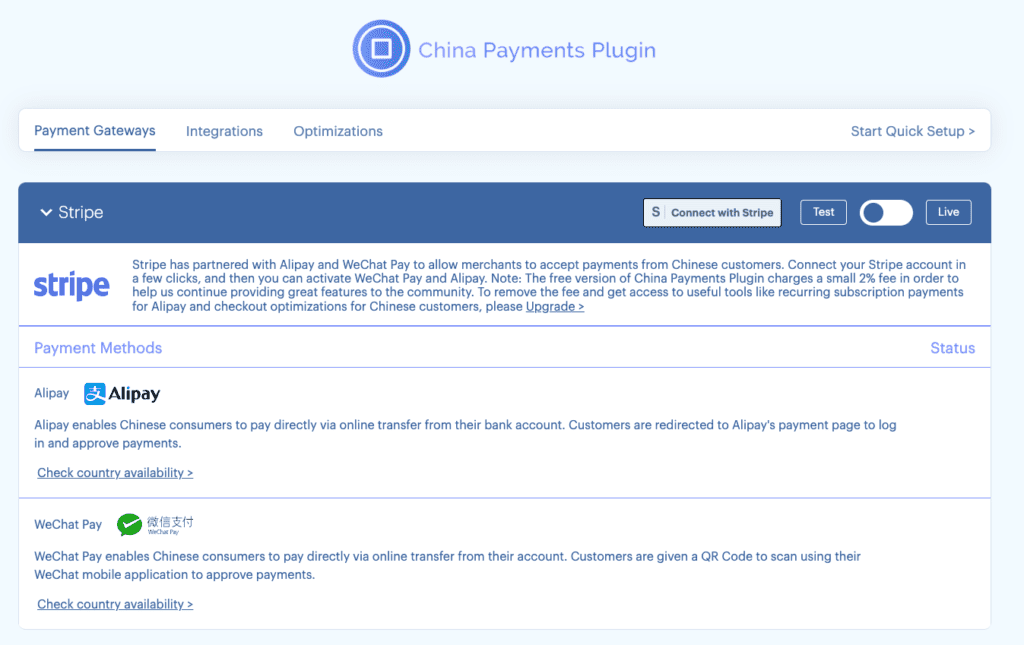

Therefore, for the purposes of this article, we tested out China Payments Plugin. Out of all the options, it appears to be the best. Additionally, China Payments Plugin also accepts WeChat Pay and Union Pay in addition to Alipay, both of which are popular payment options in China.

Additionally, it is powered by an underlying Stripe account, which makes it an excellent choice for a secondary payment gateway in addition to WooCommerce Payments.

Features

- Supports subscriptions and recurring payments out of the box

- Custom payment amounts for donations or pay-what-you-want pricing models

- Works with online payments as well as POS systems

Pros

- Easy to use for customers so reduces payment friction

- Most commonly used payment method in China

- No need to have an Alipay account to accept payments if you use China Payments Plugin integration plugin

Cons

- Creating an Alipay merchant account is tricky

- Alipay is mostly only used in China so it is for a highly specific target market

Pricing + fees

For the integration plugin, there are a few payment tiers. Free tier pricing has a 2% transaction fee, and can be used on any number of sites, whereas mid-tier pricing is subscription-based with $99 per year, but no transaction fees. China Payments Plugin fees are exclusive of Stripe’s fees though, so it is important to consider those as well. It is unclear what Alipay charges are, as there is no information on their site.

Available regions

United States, Canada, United Kingdom, Australia, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, Netherlands, Norway, Spain, Sweden, Switzerland

Payment methods

Credit cards, Alipay, WeChat, and Union Pay

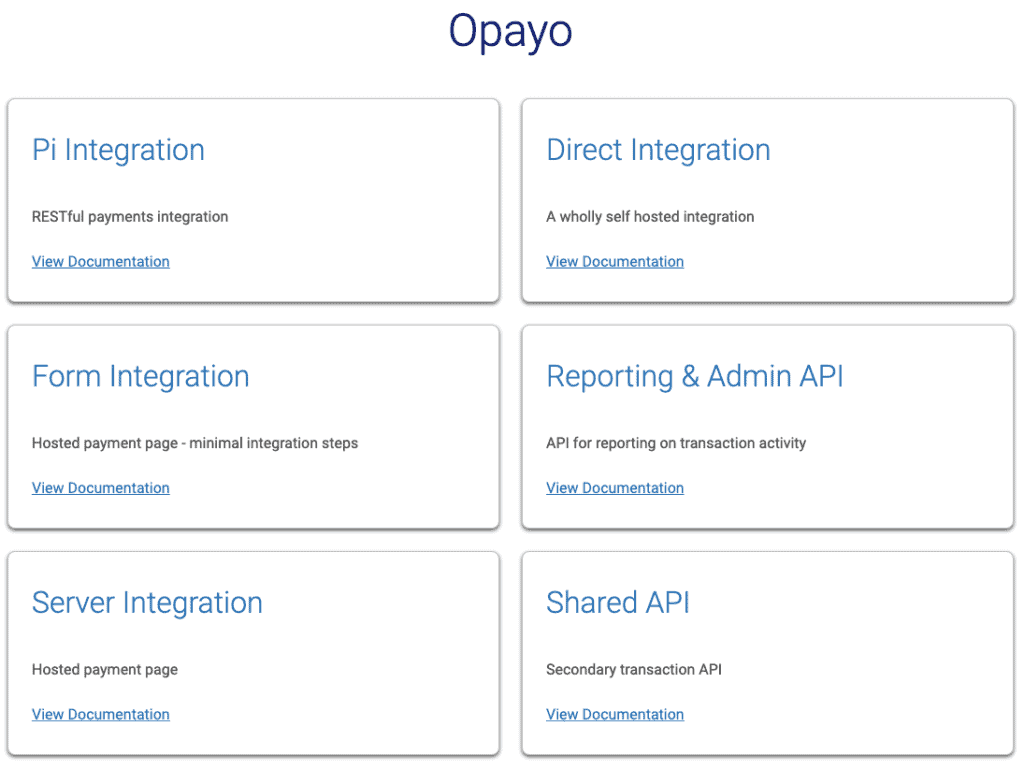

9. Opayo

Best for: Merchants in the United Kingdom and Ireland.

Opayo, rebranded from SagePay, is one of the only WooCommerce payment gateways we have tested that requires a merchant bank account. This caused us a pause, but we powered through.

To get an account with Opayo, you need to apply for one. Thus it takes a little while to get set up with an account. Once you have an account, you need to choose an integration method from their website. The third-party integration plugins left much to be desired, so we aren’t going to dwell on them at all. On the website, there are two levels of integration: form integration and server integration. The upshot is that there is some coding required, regardless of which one you choose.

Once you’ve overcome these hurdles, Opayo is an easy system to use. It is also a widely recognised and trusted payment gateway, with offline and online payment solutions.

Features

- Integrated online and offline payment with POS support

- Choice between hosted or integrated payment gateways

- Scalable pricing to suit different transaction volumes

- All levels of PCI compliance

- Various methods of integration available

Pros

- Flat pricing structure with no per transaction fees

- Included fraud detection

Cons

- Application process to get an Opayo account

- Requires a merchant account for integration

- No integration plugin

Pricing + fees

Monthly subscription fee + volume-based pricing. Customisable pricing for enterprise customers.

Available regions

United Kingdom and Ireland

Payment methods

Credit and debit cards, digital wallets, telephone payments

10. Skrill

Best for: Merchants who want to trade in restricted goods and services.

Skrill, formerly known as Moneybookers, was a means to transfer online gambling winnings. However, the company was acquired and then evolved to be a digital wallet and payment gateway for other products and services. As such, it can accept multiple payment methods from a range of countries. It has thus become a widely used payment platform for those wishing to trade in underserved countries.

The problem with Skrill is that their site is ridiculously stingy with pertinent information. We dug through the terms and conditions, documentation, help centre, and read every word. And yet, there is nary a mention of fees chargeable to a merchant. The only thing we could find is that, during the application process, Skrill will scrutinise the merchant, and “come up with a proposal”. We find this incredibly shady, so that’s where we stopped testing.

Features

- Multiple currency account for 40+ currencies

- Recurring payments supported

- Chargeback protection

- Fully PCI compliant

Pros

- Manage payments, settlements, and refunds from within WooCommerce

- Compatible with cryptocurrencies

- Available in a wide range of countries

Cons

- Lack of transparency on Skrill’s site

- You need to apply for a Skrill account, and the application is manually reviewed by the company before you can use their services

- Complex setup process for the payment gateway to work

- Website has to be in the format of www.example.com; no other format worked during the registration process (a minor but very weird issue)

Pricing + fees

There is no information on the site about pricing and fees for a merchant. The only info we could find was on another review site, so we cannot guarantee its accuracy.

Available regions

Europe, North America, South America, Middle East, Asia Pacific, Africa

Payment methods

Credit and debit cards, local payment methods, bank transfers

11. Verifone

Not recommended

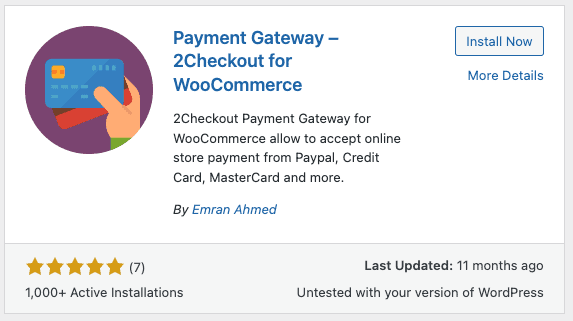

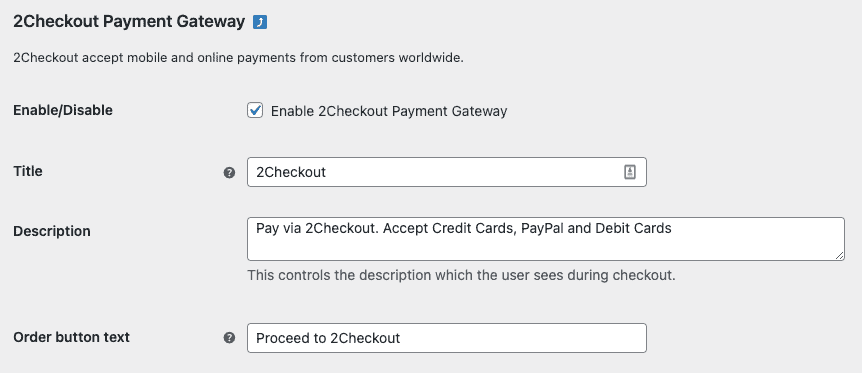

Verifone was formerly 2Checkout, but you need to look for an integration plugin with 2Checkout because searching for Verifone doesn’t turn up any results on wp-admin. We did find an integration plugin on the Verifone website, but were put off by the manual installation that was needed. We also saw the provided documentation, and the entire process seemed very technical for a payment gateway. So we opted for a third-party integration plugin called Payment Gateway – 2Checkout for WooCommerce to test instead.

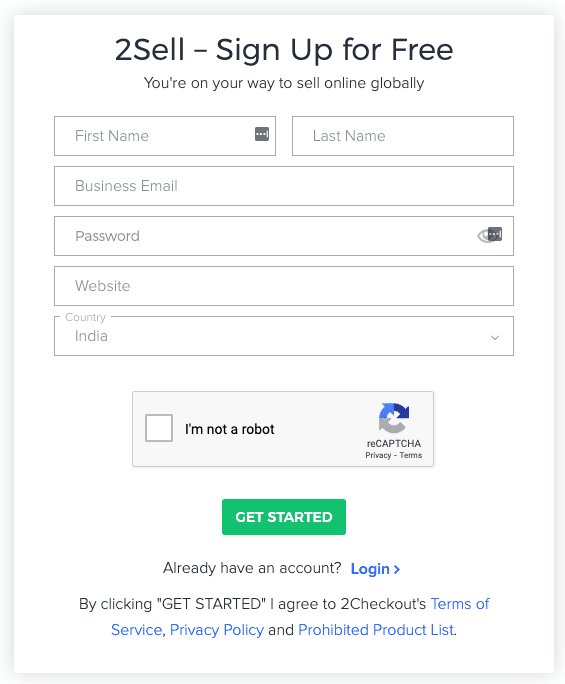

Our experience with 2Checkout was buggy from the start. It took us over 30 minutes to create an account with Verifone, because the sign up page constantly got stuck in a loop and the reCaptcha expired. Once we crossed that hurdle, the entire process was confusing and convoluted, and the support was decidedly unhelpful.

Verifone is also the most expensive payment gateway we have tested, considering none of the other payment gateways charged a withdrawal fee! For these reasons and many more, Verifone gets a definite thumbs down from us.

Features

- Accepts payments in 100+ currencies

- Hosted payment gateway

Pros

- Customisable checkout pages to match site design

- Hosted payment gateway means that your site doesn’t need to be PCI compliant

- Wide range of accepted payment methods, including cards and wallets

- Available in over 45 countries

Cons

- Buggy interface

- Poor customer support

- Settlements are on a fixed schedule only, without any facility to manually withdraw funds

- Minimum balance of $50 required for settlements to take place

- Settlements may be chargeable based on whether you are withdrawing to a bank account or PayPal

- Deposits are retained in the 2Checkout account against chargebacks

- Subscription payments are at a premium from the regular plan

Pricing + fees

- Settlements to bank accounts cost $15 each time

- Basic plan is 3.5% + $0.35 per successful sale on credit cards. Although at first glance, the pricing appears to be a flat fee, we dug through the documentation to see that specialist payment methods like digital wallets have an additional fee, as do payments from outside your country.

- Advanced support for setup is chargeable, which is pertinent because setting up on your own is well-nigh impossible for a non-technical person

Available regions

Europe, North America, South America, Middle East, Asia Pacific, Africa

Payment methods

Credit and debit cards, PayPal, digital wallets

How to choose the best WooCommerce payment gateway

Products, target audience, customers and payment methods are some of the things that should be considered when making a decision about which WooCommerce payment gateway suits your unique store. Therefore, when choosing a payment gateway for your WooCommerce site, there is no one-size-fits-all ‘best’ solution.

Hosted or integrated

Where will your customers enter their payment information?

We’ve put this factor at the top of our list because it is directly relevant to how much or how little time you need to spend securing your WooCommerce site. There are two types of payment gateway integrations possible:

- Hosted or redirect: Once the customer has finished shopping, they are redirected to an external site to complete their transaction. The external site is your payment gateway and it securely collects the payment information for processing. After they’ve entered the details, the customer is then redirected back to your site.

- Integrated or direct: The customer completes the transaction on your site. The payment details are collected without redirecting the customer, and sent to the processor.

There are pros and cons to both methods.

The hosted or redirect approach means that the security of your customers’ billing information is handled by the payment gateway. If you don’t collect any financial information, you do not need to be PCI compliant. We talk more about PCI compliance in the section on privacy and security.

On the other hand, user experience data suggests that people don’t like being redirected for transactions, and often view this process with suspicion. Cart and checkout abandonment rates are much higher for those sites that use hosted payment gateways, compared to integrated ones.

Accepted payments

How will customers want to pay?

There are various types of payment methods: credit cards, bank transfers, direct debit, even cash. While as a business owner, you may feel that credit cards are the easiest method, chances are all your potential customers may not have access to one.

When figuring out what WooCommerce payment methods to offer, it helps to have an idea of your target audience. If your potential customers are located in Japan, you need to account for the rising trend of mobile wallets. Conversely, in Argentina, most online customers prefer cash alternatives.

By offering your customers their preferred payment method, you are providing a good user experience while simultaneously reducing drop-offs. Therefore, when picking a WooCommece payment gateway, consider ones that offer a range of payment methods. Incidentally, it is entirely possible to have more than one payment gateway, but it is inadvisable to have too many on one site.

Different types of payment gateways

Are all the transactions one-time purchases, or will you have a mix of options?

Various goods and services, depending on their usage, pricing, quantity, location, and a myriad other factors, will have different types of payment plans.

If you are selling clothes or toys, you are most likely going to want a one-time payment for those items. If you have a subscription business, you want to enable recurring payments. Perhaps you are teasing the launch of a book, and you want to accept pre-order payments as well. Some ecommerce stores have wallets to facilitate repeat purchases.

All these types of payments are facilitated by WooCommerce payment gateways, so it helps to think about how you want to accept payments on your site.

Country of business and target region

Where are you doing business and where are your customers located?

Location is an important factor from multiple points of view. We talked about the privacy and security considerations for customer data. There are also custom duties and shipping charges for physical products. And last but not least, currency comes into the picture.

Most customers will want to purchase products or services in their own currencies. Adding a currency converter widget to your site is also a good idea to make the purchase process smoother for your customers. However it is always better to have transactions in the same currency as displayed on your site, otherwise it can cause confusion and cognitive dissonance leading to dropoffs.

You will want to have sales in your currency as far as possible as well. If you sell beyond your own geographical location, you will need to figure out things like exchange rates and fees.

Pricing

What will you need to pay to the payment gateway?

Pricing is a tricky factor, because there are many types of fees that a payment gateway can charge you. The most common one is a per-transaction fee, which can be a flat amount, a percentage of the sale, or a combination of both. Some payment gateways have a sign-up or setup fee, both of which are slightly different. All will require you to create an account, so some will also charge a subscription to use their services, apart from transaction fees.

Fortunately, most of the WooCommerce payment gateway plugins are free to download and install, although not all of them. If you choose to go with a payment gateway that doesn’t already have an integration, then you will be looking at developer assistance as an added cost.

Settlement timelines

When do you receive money from the payment gateway?

Payment gateways are a layer between you and the payment processor, which in turn carries out the transaction between banks or credit card companies. Therefore, settlement of dues, or when you receive actual money against your sales, can take a few days.

Previously, payouts could be made weekly, fortnightly, or even monthly. Now timelines are considerably shorter, however factors such as foreign currency transactions and different means of payment may cause delays. Settlement timelines are important for accounting purposes.

Ease of integration

How long will it take to set up the payment gateway? Will it be easy?

We recommend choosing a payment gateway that has an existing WooCommerce integration plugin. This will significantly reduce the time it takes to get everything set up and running.

If you prefer to use a specific payment gateway for WooCommerce, and it doesn’t have an integration already, you will need to get developer assistance to create a custom integration. It will also take a lot more time to configure, and will be a more expensive proposition.

Usability

How easy is it to use the payment gateway?

A payment gateway should be easy to use and understand, so that it helps you manage payments easily. You don’t want to spend time trying to understand an interface or generating reports. Therefore usability is an important criterion when choosing the right fit for your WooCommerce site.

For example, some payment gateways will have all their functionality available on their own dashboards, with basic information visible on wp-admin. Others will have more robust plugins that show you all the information on the dashboard. Both approaches have their pros and cons. Depending on what suits your needs—perhaps you prefer to have an independent payments dashboard or you don’t want the hassle of managing too many accounts—you choose an option.

User experience

Is the payment experience easy for your customers to use?

It is difficult enough to retain customers, and get them to complete transactions. When everything else is going well, user experience can be a stumbling block. In fact, tests have shown that an uneven or difficult payment experience leads to cart abandonment and other issues.

Poor payment experience constitutes many things. Maybe the products are listed in one currency, but the checkout is in another. Perhaps the payment gateway doesn’t include a customer’s preferred payment type. Repeated payment failures or timeouts are also an annoying experience. Look for a payment gateway that is reliable and has good customer support to resolve issues quickly.

Also, it helps to have multiple payment options, because that increases the probability that customers will complete the checkout process. However, there is a thing as too much choice as well. Too many options can become overwhelming and difficult to manage.

With WooCommerce, you can integrate more than one payment gateway. We actually recommend this course of action, if one payment gateway doesn’t give you all the functionality you need. However, we also recommend exercising restraint to keep your site functional.

Although we have listed all the factors you can and should consider, it depends on your requirements how much weight each one carries. Perhaps you need more payment methods, and fewer currencies accepted. Or maybe the opposite is true. Either way, it is vital to make a considered decision.

Privacy and security

Regardless of which other factor you prioritise, privacy and security should be of paramount importance to you. As an online seller, you will be dealing with customers’ billing details at some level. You’re obligated to ensure that they are accorded the maximum security and privacy you can give them, and that means choosing a reputable payment gateway.

A customer’s private information is any personally identifiable details about that person, including their names, street addresses, email addresses, and phone numbers. In addition to this, private information also comprises customer’s billing details like credit card numbers or bank account details.

How to read privacy policy documents

When thinking about which payment gateway to choose, you will need to read privacy policies and terms of service documents thoroughly. These documents should contain everything you need to know about how the payment gateway will handle your customers’ data. It will enable you not only to make an informed decision, but to also reassure your customers that their data is safe when they transact on your website.

Please note: The information contained here is intended to help you ask the right questions, but in no way, shape, or form constitutes legal advice. Please consult with a professional legal advisor before making any decisions based on this information.

- How data is collected: Online or offline, collated with other sources of data, cookies, trackers, etc.

- What data is collected: personal data, email addresses, names, ethnographic data, demographic data, etc.

- How the collected data is used: order fulfilment, retargeting, ads, email marketing, user experience design, etc.

- What data is shared with third parties: email marketing providers, shipping companies, advertising platforms, etc.

Under many laws, the customer has the right to refuse to let their data be used. Depending on your business location and the location of your customers, you will need the appropriate privacy and security measures.

SSL certificates

SSL encryption has now become the de facto standard for websites, and WooCommerce stores are no exception. SSL encrypts the communication to and from a website, so that data transmitted cannot be intercepted and read by unauthorised parties.

SSL certificates are usually available from web hosting providers. Failing that, you can apply for one directly from a certificate authority. SSL encryption is a big part of website security, and an essential step of WordPress hardening.

PCI-DSS compliance

Payment Card Industry Data Security Standard (PCI-DSS) is a standard for data security that anyone dealing with credit card payments must adhere to. It is managed by a council and is intended to protect customers from credit card fraud.

As you will be accepting payments, you will be handling customer card information at some level—either on your site or with the payment gateway. This depends on whether you opt for an integrated or hosted payment gateway.

With integrated gateways, even if you only accept the credit card number, and all other information is collected at the payment gateway or processor level, you still need to be PCI compliant.

Whereas, with a fully hosted gateway, all the data is handled at the payment gateway level, so you can skip the compliance altogether.

At the very least, you need to install a WordPress firewall on your site. The compliance process has more steps though, but fortunately there are great resources to help you get compliance for your WooCommerce site.

How a payment gateway works

As we know by this point in this guide, a payment gateway enables a WooCommerce store to request payments from customers. The payment gateway protects the interests of both the customer and merchant by making sure the transaction completes securely and as seamlessly as possible. The payment gateway verifies customer billing details, authenticates funds, and facilitates the transaction between both parties.

Although the terms payment gateway and payment processor are often used interchangeably, they are actually different. What we are referring to as payment gateways in this article are actually payment aggregators, which function as both gateways and processors. For the most part, you will not need to differentiate between them. Gateways collect billing information and customer details from an online eCommerce store, much like a credit card machine at a physical store. It then forwards this information to the processor, who in turn communicates with the banks involved. The actual transaction happens here, with information being exchanged, fees, disputes, refunds, and all the rest happening here as well.

You can skip the payment gateway altogether and opt for a payment processor directly, however the setup and compliances tend to be more difficult. The payment gateway steps in the middle to take care of these steps, so that integration for you is easier. In fact, all on this list are payment aggregators in any case. Additionally, to integrate a payment processor, you will need a merchant bank account that accepts all kinds of payments.

How to move from one payment gateway to another

There are many reasons to shift from one WooCommerce payment gateway to another: better pricing, better features, better support, and a growing store are a few good ones. However, once you’ve made that decision, do keep a few things in mind.

- Make sure to set up a maintenance mode plugin when making any changes

- Put your WooCommerce store and all active payment gateways in test mode

- Export all the information and save it securely. The quickest way to do this is to use BlogVault to take a full site backup

- Keep both the old and new options running simultaneously for some time to ensure everything works correctly.

Conclusion

We’ve listed the best WooCommerce payment gateways currently available. To pick the best option, you need to carefully consider what your requirements are, and choose accordingly. In most cases, one WooCommerce payment gateway will not have all the features you require, so you can install a few at a time. We recommend up to 3 options only though, because too many will increase admin considerably.

Whichever payment gateways for WooCommerce you choose to opt for, keeping your store safe from hackers is of primary importance. Install MalCare, a dedicated WordPress security plugin, which combines a scanner, cleaner, and an advanced firewall to protect your site.

FAQs

What is the best payment gateway for WooCommerce?

WooCommerce Payments is the best payment gateway for a small WooCommerce site. It is widely available, and accepts most currencies. The integration plugin is free, and works out of the box, since it has been developed and maintained by WooCommerce. The charges per transaction are the standard ones across all payment gateways, and there is no subscription or membership fee for a WooCommerce Payments account.

How do I set up a payment gateway on WooCommerce?

To set up a payment gateway on WooCommerce, you first need to install an integration plugin or an extension from the marketplace. WooCommerce has integration plugins for most of the popular payment gateways, but apart from the WooCommerce Payments one, the rest are mostly unreliable.

Depending on which payment service you choose, you will need to create an account, and submit your details for verification. US-based payment gateways have stringent requirements, and will require your social security number in addition to a valid address and account number. You can expect the verification process to take a few days before the service is activated.

Does WooCommerce do payment processing?

Yes, WooCommerce Payments, which is a payment gateway offered by WooCommerce, does payment processing.

What payments does WooCommerce support?

WooCommerce, by itself, cannot support payments. However, if you install a payment gateway like WooCommerce Payments, Stripe, or PayPal, your store can accept most credit and debit cards easily. In fact, keeping your target audience in mind, you should consider payment methods when choosing a payment gateway to integrate.

What is a WooCommerce payment gateway?

A WooCommerce payment gateway is an extension that enables you to accept payments from customers on your online store. A payment gateway is a bridge between the customer, the merchant (you), the payment processor (which carries out the transaction), and the banks of both the merchant and customer. It collects the billing details securely from the customer, and passes it on to the payment processor.

In several cases, the payment gateway is combined with the payment processor, so a merchant doesn’t have to sign up for 2 separate services. Generally, this combination makes it much easier for the merchant, as they don’t have to have a merchant account, which is necessary with a payment processor.

Can you use multiple payment gateways on WooCommerce?

Yes, you can use multiple payment gateways on WooCommerce. One payment gateway is unlikely to accept all methods of payment, and to offer your customers a variety of payment options, you can install 2-3 different payment gateways. However, we advise caution here, and less is definitely more. More than 3 payment gateways will become difficult to manage, as the number of dashboards will increase proportionally, and you will have to collate data manually.

Category:

Share it:

You may also like

MalCare Ensures Unmatched Protection Against User Registration Privilege Escalation Vulnerability

Imagine discovering that your WordPress site, which should be secure and under strict control, has suddenly become accessible to unauthorized users who have the same administrative powers as you. This…

MalCare Ensures Proactive Protection Against WP-Members XSS Vulnerability

MalCare continues to protect its customer sites from all kinds of attacks, even the ones exploiting zero-day vulnerabilities. The recent stored cross-site scripting (XSS) vulnerability found in the WP-Members Membership…

![Top 9 ManageWP Alternatives To Manage Multiple Sites Easily [Reviewed]](https://www.malcare.com/wp-content/uploads/2022/12/malcare-default-image.jpeg)

Top 9 ManageWP Alternatives To Manage Multiple Sites Easily [Reviewed]

ManageWP is a popular name in the WordPress maintenance plugins market. People love how much you get for a free plan, how easy it is to set up, and how…

How can we help you?

If you’re worried that your website has been hacked, MalCare can help you quickly fix the issue and secure your site to prevent future hacks.

My site is hacked – Help me clean it

Clean your site with MalCare’s AntiVirus solution within minutes. It will remove all malware from your complete site. Guaranteed.

Secure my WordPress Site from hackers

MalCare’s 7-Layer Security Offers Complete Protection for Your Website. 300,000+ Websites Trust MalCare for Total Defence from Attacks.